Successful business owners everywhere reach a point when they need to find more efficient ways of conducting business. As their company grows, they look for ways to keep up with the demands placed on their operation. But today’s entrepreneurs want more. They want to remain in control of their business as it expands by keeping processes centralized and having access to information and real-time data that can be key to their decisions. This involves updated, quality software that not only improves functionality, but that truly understands the type of business it serves. This is what Eastern Union Funding, a private real estate mortgage brokerage, set out to find when they turned to Bitbean for answers. Eastern was looking for software that understood the mortgage brokerage business while at the same time helped to support its clients and brokers. By building a customized, user-friendly system to help accommodate Eastern’s fast-growing business, Bitbean succeeded in making their ongoing processes more efficient. They designed user-friendly software to provide streamlined functionality that handles all aspects of Eastern’s transactions to centralize operations, thus giving them greater control. Bitbean’s customized software works in tangent with Eastern’s business model and creates value for brokers to motivate their participation in using the system resulting in continued success.

About Eastern Union Funding

Catering to small and midsize commercial borrowers, Eastern Union Funding is a New-York based mortgage brokerage that was founded in 2001 by CEO and President, Ira Zlotowitz, and his partner, Abraham Bergman. Listed as one of New York’s top 50 fastest growing companies by Crain’s New York Business, they help thousands of clients secure billions in loans by providing sales broker listings, funding options, and loan facilitation and negotiation. By building relationships with multiple banks and institutional lenders, Eastern’s broad network insures that clients will receive exceptional results. Starting in Brooklyn with a small office of two, Eastern now boasts over 100 employees and currently closes over $5 billion in national loan volume annually.

Challenges with the old software

Not user friendly

As Eastern experienced business growth, their existing software couldn’t efficiently keep up with increasing transactions (this was despite an excellent infrastructure in place) and was not user friendly. Those who did use the old system found it to be counter intuitive. Employees wouldn’t use it and brokers went outside of the system to connect with clients. This made it difficult for Eastern to keep track of the increasing number of business dealings. Without dedicated usage by staff and brokers, the daily overview of business transactions may be inaccurate or incomplete.

Inefficient and limited

Eastern’s old system was struggling to keep up with the day-to-day business. Loan processing was slow and became troublesome with an ever-increasing number of transactions. The inability to properly track hundreds of quotes and other dealings rendered the system ineffective. Without centralized software to efficiently handle and process the various transactions, Eastern found it difficult to stay in control of activities.

Unsuccessfully connecting brokers

There was no real value to brokers that would encourage them to use the old system. Without a sense of affinity to Eastern, it was difficult to provide clients with a community of brokers willing to service them properly.

Business requirements

As an innovative company, it quickly became important for Eastern to incorporate a seamless platform that would fully facilitate business growth, centralize transactions, service clients, and connect brokers and lenders while integrating data and technology. More importantly, the new system must understand the day-to-day operations of a mortgage brokerage firm. For this reason, off-the-shelf software was not an option for Eastern as it lacked specific functionality that was important to their business not to mention included “extra features” that were of no value. And although Eastern had an in house IT team, it was clear the team needed support as they were connected to the daily operations of a mortgage broker and not in the business of developing software. With that in mind, Eastern looked to the experts at Bitbean to help by customizing software that was designed for their specific ways of conducting business.

How bitbean helped

Bitbean heeded the call to meet Eastern’s technology needs by developing a scalable system that performed to their business specifications. The new software was designed to integrate with Eastern’s mortgage brokerage operations by increasing functionality that was specific to their business model. As an on-shore developer, Bitbean was the most cost-effective software developer option for Eastern as Bitbean better understood their clientele and brokerage culture and had the ability to work quickly and in-person. In addition, Eastern’s CEO and President, Ira Zlotowitz, had previously worked with Bitbean on a non-profit project and felt confident that the software developer would be able to meet the demands of their business. As experts in their field, Bitbean quickly started from scratch with a customized system that would comprehensively handle Eastern’s unique business model.

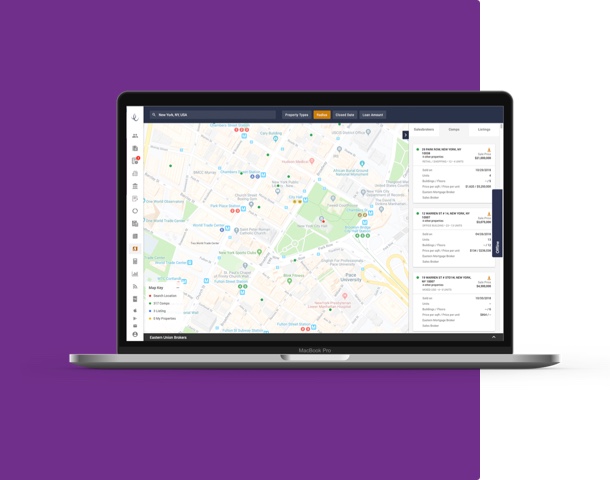

By helping Eastern integrate their business structure with quality software, Bitbean was successful in developing a centralized and fully integrated system that benefits clients and sales brokers. The new, centralized technology now handles all transactions including the tracking of hundreds of quotes, offers, and bids, provides business intelligence for borrowing, and includes a document management system. In addition, the system is also capable of pre-qualifying clients and providing assets information to banks to generate quotes while collecting data regarding properties. Ultimately, it is designed to streamline transactions and move clients quickly through the lending process. But no matter how efficient a system, it must be user friendly. The new intuitive software, Loan Tracker, provides easy-to-use functionality that gives users confidence and saves time, which is instrumental in increasing overall productivity.

The system also provides business intelligence to aid in borrowing at the best rates, CRM component, and a document management system. By adding these invaluable tools including a comprehensive portal to help brokers, Bitbean brought value to the table that keeps these mortgage brokers coming back to take advantage of system features. The web-based portal was created to provide convenient tools for real estate professionals to efficiently perform underwriting and generate mortgage calculations. It also provides live rates, CRE news feed, comprehensive directory of commercial real estate professionals/lenders, and real estate comparables. In addition, a new app built for Eastern gave brokers the ability to do everything “on-the-road” that they would normally do in the office on the portal. This new-found mobility was the first of its kind and provided an innovative way for mortgage brokers to do business.

Results

Bitbean built a new user-friendly system for Eastern that is efficient, centralized, and fully integrated with the business. Speeding up the loan process and the ability to handle hundreds of transactions seamlessly helped to improve relationships with clients while at the same time, increased the fostering of relationships with lenders. The online portal helped clients find the right real estate professional to service them properly and connected brokers with a full range of functionality. In addition, the mobile app provided brokers with everything at their fingertips, which gives brokers the ability to quickly advise clients, have more time to build their teams, and ultimately get more work done. Since implementing the new system, Eastern has experienced incredible growth beginning with a record year of $1.875 billion. The company gives a lot of credit to the improved technology, which is capable of efficiently handling hundreds of transactions. Eastern continues to grow and boasts a successful 2019 with over $5 billion worth of business and plans for more in 2020.